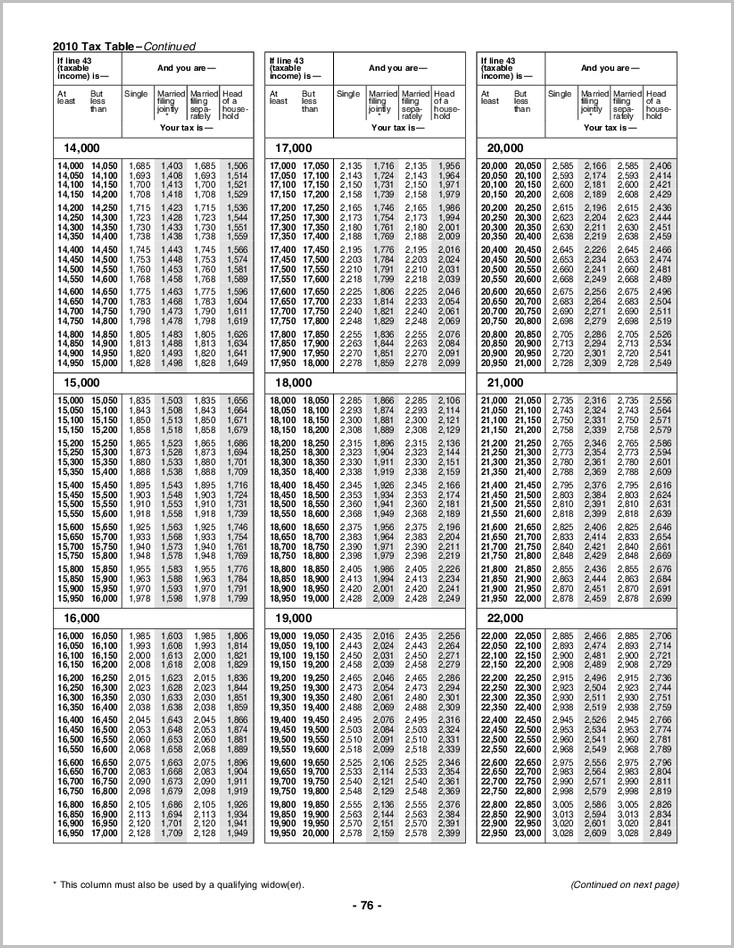

This is more likely to be true for people who bring in most of their income through traditional W-2 employment. Remember that your taxable income does not necessarily include every dollar that you bring in there are a number of different deductions that allow your taxable income rate to more accurately reflect your disposable income.įor 2019, the standard tax deduction is $12,200 for single filers, $18,350 for people filing as head of household and $24,400 for married couples.įor many people, taking the standard deduction is the best way to simplify their taxes, and itemizing their deductions will not produce greater tax savings. Instead, you can use tax credits and deductions offered by the government in order to offset your tax burden or reduce the amount of your income that is taxable. This does not involve evading taxes or violating the law. There are several ways that people can work to reduce their tax bills even when they are bringing in a larger income. May have no income tax and rely on sales and other forms of use taxes. Have progressive income taxes of their own, they may have a flat tax or they Of course, this is only for federal income taxes. You will always pay taxes at your highestīracket only on the amount of your income above the starting point for that Not pay one rate for your entire federal income tax burden instead, each chunk Into pieces, and each segment of your income fits into a tax bracket.

$34,000 of their income, absent any other credits or factors that could affectĮssentially, the federal government breaks your income up However, they will pay only the same taxes at the same rate on the first More taxes and at a higher rate than someone who makes $34,000 each year. On the amount of income that you bring in that is above and beyond the startingįor example, a person that makes $340,000 in taxes will pay Instead, you will pay an increasing marginal tax rate only However, high earners do not pay that higher tax rate on This means that you pay higher rates of income tax when you have a higher income and a lower rate of income taxes if you have a lower income. While rates have flattened sharply over time, the U.S. In order to understand tax brackets, it is important to keep in mind that not all of the income that you make is taxed at the same rate. Find An Accountant > Understanding Federal Tax Brackets

0 kommentar(er)

0 kommentar(er)